This notice provides important information regarding your IRS Form 1095-C for the 2025 calendar year. Form 1095-C provides details about the health insurance coverage offered to you through the Florida Department of Management Services, Division of State Group Insurance (DSGI) by your current or former Florida state government employer during the year, as required by the Affordable Care Act (ACA). They should be available sometime in late January. For questions, please contact the People First team at 866-663-4735.

Recent Changes in Federal Law: Under the federal Paperwork Burden Reduction Act, employers are no longer required to automatically mail or email Form 1095-C to all employees. Instead, employers are now required to make this form available upon request.

Important Note for Your Taxes: Filing Form 1095-C with your personal income tax return is generally not required. Please consult with a qualified tax advisor for questions about your individual tax situation.

How to Request Your Form 1095-C: The quickest way to obtain your 2025 IRS Form 1095-C is to download a copy from People First.

1. Log in to People First.

2. Click on the Insurance Benefits tile.

3. Select the Health Insurance Tax Forms icon.

4. Click the Tax Form 1095-C.

Download this PDF for complete details and instructions.

To make sure you have chosen to receive your 1095-C electronically, follow these instructions: (see pictures below)

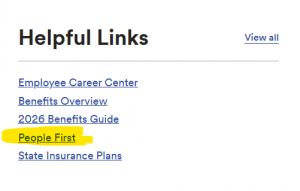

- Log into ADP Workforce Now and click on People First under Helpful Links.

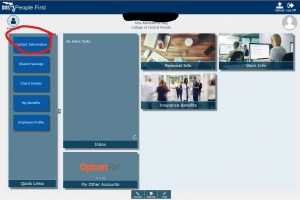

- Log into People First and click on Contact Information on the dashboard.

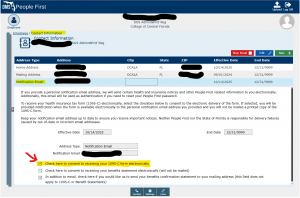

- Click on Notification Email on the Contact Information page.

- Make sure the box beside ‘Check here to consent to receiving your 1095-C form electronically.’ has been checked.